Debt can be a tricky and scary subject for a lot of people. Nobody likes the idea of owing someone else money, but, unfortunately, there are situations in which it is necessary.

Debt can take many years to pay back and can sometimes even incur high interest rates and fees, if it is not repaid on time. These are all very serious things to consider. Here we will examine the good and bad reasons to go into debt, looking at the advantages, disadvantages, and consequences of each one.

Good Reasons to Go into Debt

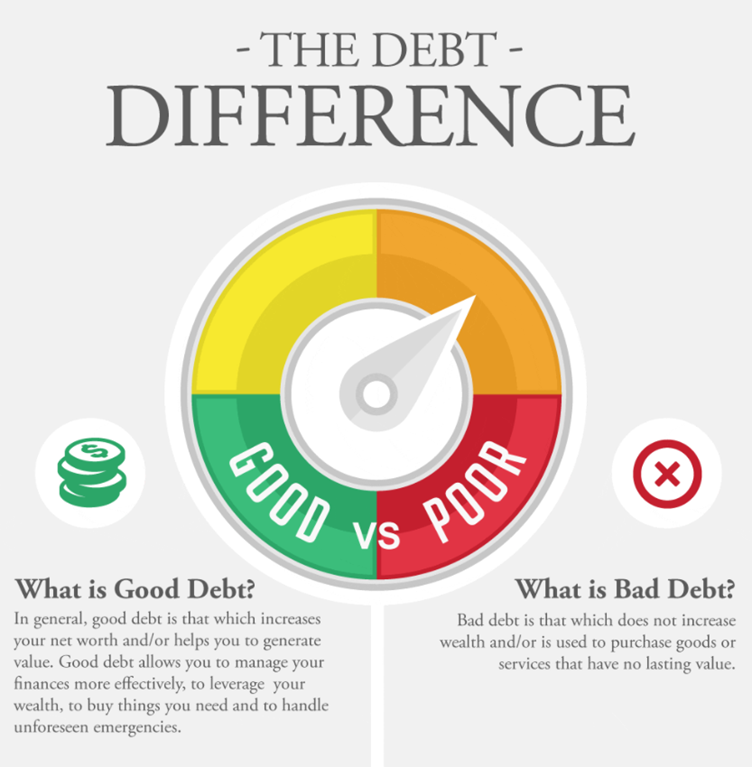

Although debt is typically viewed as a negative thing, there are some examples of it in everyday life that you may not have necessarily thought of as “debt”.

Mortgages

Although in an ideal world everyone would be able to purchase their forever home outright this is often not the case. Most people simply cannot afford to pay the entire value of their home as one lump sum.

There are, however, capable of paying a decent sum of it off every month in installments over a long-term period. This is a mortgage.

Banks will consider many things before offering a person, or couple, a mortgage. They will look at their income, their credit score, and the value of the property that they are considering. This will allow the bank to get a clearer understanding of the buyer’s financial situation.

Without a mortgage, most Americans would not be able to afford to buy their homes. It is certainly an investment, but a worthwhile one.

Student Loans

Another incredibly common form of debt is student loans (https://thinksaveretire.com/two-reasons-debt/). Although this is not the case for every country in the world, it is particularly prominent in the United States of America. Although lower education is state-funded, higher education is not (on the whole, ignoring scholarships and grants).

This means that to get a better education, either out of personal interest or to further a career, most students will need to take on debt in the form of a student loan.

A student loan is a good investment if it is used to further your future, to help you in your chosen career path, and enhance your knowledge.

If you are simply getting a student loan to go and party, then it certainly will not be a good investment. You may simply end up with debt and no degree to show for it.

Business Loans

Starting your own business can be a costly affair that, unfortunately, most people cannot afford. Whatever the business is there are likely to be set-up costs such as for an office, equipment, and staff. These can add up very quickly and so a loan from a bank, private company, or individual can be a good option to finance this.

Again, with the bank loan, you will be carefully considered to better know if you can be trusted before any such loan is offered to you.

You will need to carefully assess whether or not the business is a reasonable and sensible use of time and money. If it seems too good to be true then it usually is. Make sure that you consider everything necessary to your potential business and its field before taking on debt.

Bad Reasons to Go into Debt

There are more bad reasons to go into debt than there are good ones. These are perhaps the forms of debt that immediately spring to mind when you think of the subject. Here we will name a few to give you a rough idea of what to avoid.

Shopping

Nowadays with social media and the online glamour geared around luxury goods more and more people are racking up credit card debt to pay for things that they simply cannot afford.

They buy luxury cars, bags, and jewelry to impress family and friends. If you can afford it, this is fine. But as soon as you go into debt, it becomes a dangerous downward spiral.

Simply living beyond your means can get you into serious financial trouble, worse yet if it is an addiction.

Gambling

Unfortunately, gambling can be a serious addiction for some people and this is only exploited by companies whose betting websites and poker tables are all too easy to access and use.

People often find themselves betting larger and larger amounts of money to recoup the money that they have already lost.

This is only made worse if you cannot afford to do so. If you are getting into debt for gambling, then the likelihood is that the problem is not going to get better. Unlike debt as an investment (good reasons to get into debt), gambling is simply a game of chance.

Risky Business Ventures

Just like going into debt can be a good thing, if you are starting a viable and hopefully profitable business it can also be a bad thing. If you have not given serious consideration to the business that you want to start then you may be getting into debt for bad reasons.

If the business fails and you are not able to repay the debt (for example, if you were banking on your business becoming successful) then you are significantly less likely to be able to get a loan from the bank in the future.

That means that you should carefully and seriously consider the product, the business plan, and the market in which you hope to establish yourself. This will then give you a better indication of whether the business is a good or bad reason to go into debt.

Vacations

Just as material items are a bad reason to go into debt so too are vacations. Although we all feel like we need a break every once in a while, it is not worth ruining yourself financially. They may help you mentally in the short term, but this debt can be disastrous in the long term.

Again, any form of living beyond your means is a bad reason to go into debt.

Paying Off Debt

Going into debt to pay off other debt is almost always a bad idea. Often, you will confuse payments and can end up with higher interest rates. The only good way to do this would be to consolidate your debt into a loan with better terms.

Conclusion

Although debt is socially seen as a negative thing, it can have advantageous consequences. If you consider the consequences of going into debt and find that it is a good reason (to further yourself, your work, etc.), it might be worth the short-term consequences.

However, if you are going into debt for bad reasons such as living beyond your means, then you are going to, unfortunately, have a financial nightmare. This can ruin your prospects and affect things such as buying a house and your credit score.

Related Posts