One of the very first things a new homeowner does is protecting their safe haven. Property damage or loss is feared thoroughly and anyone who makes an investment like buying a house also invests in insuring it at the very beginning. Insuring a new car or a vehicle after buying or leasing one is also considered as a fair tradition followed by many. Similarly, after buying a precious piece of jewelry or inheriting some age-old heirloom, insuring your liquid assets should be the first and foremost thing to do. Jewelry insurances cover all costs related to damage or theft of your possession.

Getting jewelry insurance in today’s world is as easy as a cake walk. All it takes is perseverance, trust and some good amount of research to figure out which company will offer the fairest deal of all and help secure your jewelry from damage of any sort. After all, gold and diamond jewelry are considered to be amongst one’s prized possession. Here is a list of thing which one should follow before insuring jewelry:

- Make documents of your collection – Worst case scenario is if you lose your jewelry while undergoing the process of insurance or even before buying one. You should always document all the jewelry you possess in your collection with details of every last piece. If your jewelry is stolen, the documentation can help you when you seek help from the police and your insurance company too. These documents should include information about the type of jewelry, the weight of the jewelry, gem certificates, bills, when it was purchased, from whom it was bought, etc.

- Get best deals and quotes from online forums – Before investing in jewelry insurance, you should always seek help from online guides because you can get information on several deals available. Most insurers have online calculators and it might help you crack the best possible deal from multiple options. You can also avail personal quotes and information about different policies that are running in the market. If you have enough idea about how much investment you’re required to make, buying the best insurance will also become an easy deal for you.

- Get a jewelry appraisal before insuring – Getting a written appraisal from the store you bought your jewelry from should not be a difficult task. Getting your jewelry appraised from a jeweler or appraiser with bare minimum cost will only accelerate the process of getting it insured. There are many insurance companies who specifically ask for appraisal documents before granting the insurance.

- Don’t always go by the existing renter’s insurance policy when it comes to protecting your jewelry too – The fact that renters insurance will always cover loss or damage of property when it comes to jewelries too is not always true. However, standard home insurance does commonly cover property damage of all sorts but you should always take loopholes under consideration. It has been seen many times that the homeowner wasn’t aware of the fact that renters insurance did not cover jewelry protection. Make sure that you’ve protected your valued items in a well-informed manner.

- Do proper homework before buying an insurance – This goes for all sorts of insurances. Knowing the best policy, the most favorable outcome, researching and reviewing terms and conditions, knowing about the goodwill of the company, are the standard actions you should take before investing in jewelry insurance.

- Always know how flexible your lifestyle is before purchasing insurance – Jewelry insurance is something which you cannot do every other month. It’s something you’ll value and cherish for long. Since there are several types of insurance available which can cost you differently, you should consider your way of life before buying the insurance. If you are into traveling, you should consider buying insurance which will be applicable beyond the compound of your residence. Look for insurances that have ‘wear and tear’ policies, given that you love flaunting your jewelry often. See if your policy includes ‘mysterious disappearances’ if you have a regular habit of losing your possessions. Make sure of what type of insurance you’re buying depending on how you use your jewelry.

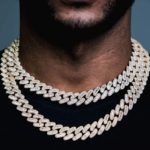

Jewelry is that part of your personal life which leaves an impression forever. People often take pride in them, flaunt them, use them in time of need, also hand them over to future generations. There are several stories of inheriting generation old necklace or age-old engagement ring in families. Jewelry is like sentiments that are irreplaceable and hence it is important to protect and preserve them as they are legacies worth carrying forward.

Related Posts