Most people do not realize how important a Social Security card is until they’ve lost it. Applying for jobs and bank loans, filing taxes, and securing employment are just a few of the things a US citizen cannot do without this card. Those who have lost their cards should get replacements and make efforts to secure their identities immediately.

People who delay in taking the right measures after losing their Social Security cards are at risk of getting into danger. If cards fall into the hands of identity thieves, cardholders may end up paying for loans they did not apply or use. Fraudsters may also get credit cards using someone’s SSN.

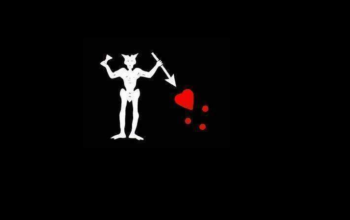

A Card In Wrong Hands Is Dangerous

Criminals who possess Social Security cards of other people can do almost everything real owners can. The situation could be even worse if they get other details like names and addresses. For instance, a thief could get into someone’s bank account, make transactions, and leave no evidence behind.

What to Do First

Whether people have lost their wallets or purses, been victims of theft, or misplaced their cards, the first thing they must do is secure their identities. Many people recommend that those who have lost their cards should contact the Social Security Administration (SSA) first. This is not exactly true.

The major reason for contacting SSA is to apply for a replacement card, and the process may take longer. However, identity security is more important. It ensures that no one uses a cardholder’s number to ruin a good name. After securing their identities, cardholders need not worry how long it would take to get new cards.

To protect their identities, cardholders should follow the following steps:

- Search for the cards. It is possible for cardholders to worry over cards that they just misplaced in their homes, cars, or workplaces. They should calm down before making thorough searches. If nothing comes out of it, then they should proceed with the following steps.

- Contact credit bureaus. The three main credit bureaus are Equifax, Transunion, and Experian. Asking them to place fraud alerts on cardholders’ credit cards halts every suspicious activity.

- Contact the Federal Trade Commission to file complaints. Grievances are important in prosecuting identity thieves.

- File reports at local police departments with their FTC reference numbers and affidavits. Such reports are important in proving cardholders’ innocence and who the thief is.

- Monitor bank accounts and credit cards closely. Set up alerts. Also, they should consistently check reports of all major credit bureaus.

Apply for Replacement Card

If searches yield no fruit, cardholders should apply for replacement cards. SSA takes about two weeks to replace a lost Social Security card. The application is free. Those who meet certain requirements may do so online. However, the process is strict, complex, and applicants may end up with rejected applications.

Which is the Easiest Way to Go about This?

Easy here doesn’t mean free. However, with a small fee, applicants can be sure of a quick, hassle-free, and successful replacement process. Only they must engage trusted third-party agents. Some agents even offer their clients identity protection services for free.

Related Posts

Hi there! I’m Sethu, your go-to guy for all things tech, travel, internet, movies, and business tips. I love sharing insights and stories that make life more interesting. Let’s explore the world together, one article at a time!