If you ever find yourself in financial hardship, you may need to shop around for a loan. As you do research, you may run into many different loan types. One of the options that may be available to you is the title loan.

Unfortunately, a title loan is a high-interest, short-term loan—meaning that the person will have to repay a significantly higher sum than they initially borrowed.

So, if title loans are so expensive why are they not yet a thing of the past?

What Are Title Loans?

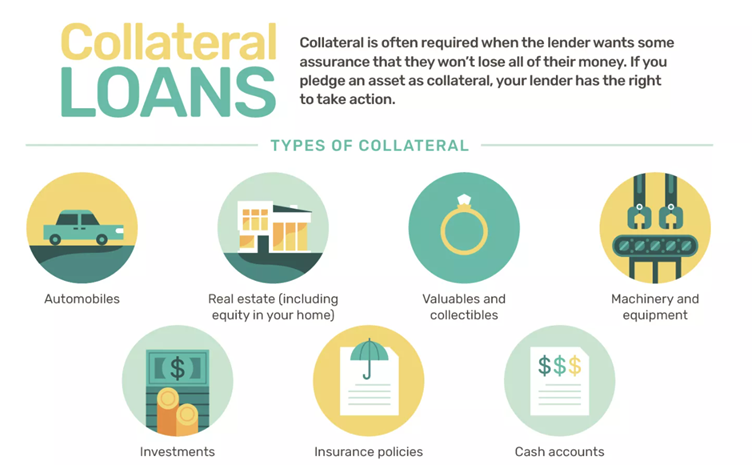

Title loans are loans that use your vehicle as collateral in the case that you do not manage to repay the full amount of the loan. They work much the same way as a pawnbroker would offer you money for your car with the option to buy it back.

Your car will be valued by the loan company (typically this is in the region of $100-$1,000) according to certain criteria, such as:

- When was the car made?

- What is the model of the car?

- What brand is the car?

- Does it have any damage?

You will then be offered the loan amount to be repaid with high interest (normally this is around 300% APR). A title loan can last anywhere from one month to a year, depending on the state.

In the case that you do not repay the money, the company keeps your car as payment. That way they put themselves at no risk.

How Do I Apply For A Title Loan?

One of the main reasons why title loans are not yet a thing of the past is that they are so easy to obtain. There is almost no effort on the part of the applicant. All you need is a lien-free vehicle.

You will simply need to find your title deed for your vehicle, fill out a short form with your details, and upload a picture of your ID (to prove that the car is indeed yours).

If your application is successful the loan sum will be transferred into your bank account.

Why Are Title Loans Necessary?

One of the main reasons why title loans are necessary is because they are easy. The application process is very simple and kept as straightforward as possible.

That means that if you in need of a quick cash boost, you will not need to wait to be approved by a bank or other large lender, where you can expect a thorough check.

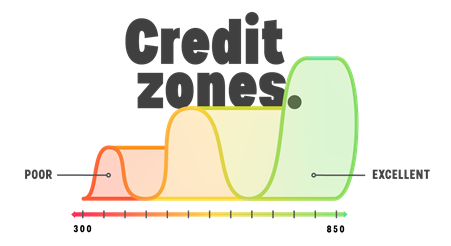

One other major reason why title loans are necessary is that they do not (usually) require a credit check. The physical car removes any risk on the company’s part.

This means that if you have a bad credit score (for example, if you have a history of debt) or even if you have no credit score at all, you can be approved for a title loan.

So, whereas you would probably have been rejected for a personal loan by a bank, you can get a title loan without any problems. Although the risks are higher and the interest is significantly higher, for some people this is their only option.

Their past credit history simply means that they do not have these other options open to them. The title loan is their only choice to obtain the sum that they need. Therefore, many people choose to go with a title loan, knowing that it is a worse option, simply because it is the only thing they can do.

Conclusion

So, although many people are well aware that title loans are one of the worst loans from a financial point of view, they are the only option for some people—for example for those with bad credit scores.

The money is transferred into your bank account quickly and easily and the process is relatively simple. This means that those of us in a pinch can get access to the extra money that we need very easily.

If you know that you are getting more money next month, but are just a little short this month, you may well be able to afford the high interest rates and any extra fees. Indeed, it may be worth them depending on how much you need to borrow.

Related Posts