Good and Services Tax is introduced to reform the tax structure of the country, and it is successful to a greater extent of how taxpayers file returns and pay taxes. The simplified procedure of paying taxes through the GST online portal has created a great deal of efficiency for individuals and business people. Earlier, there were lengthy processes that one had to go through to file taxes.

With the launch of the GST online website, it is just with a few clicks anyone can submit their returns. To avail of the benefits of the online portal, you must be a registered taxpayer under GST.

It’s a simple process to register.

- You can log in to the GST portal

- Fill in the required details

- Submit your documents

- and get yourself registered.

Upon successful registration, you will get GSTIN, which is Goods and Services Tax Identity Number. Anyone who gets registered under GST avails this number. For the legitimacy of the registration, there is an option of GST number verification on the GST portal. The advantage of GSTIN verification is that you can check whether the business you are dealing with is legitimate or not. It also helps you gain more trust with the people who do business with you.

How to get Goods and Services Identification Number?

To obtain GSTIN, you must register yourself under GST. Registring under GST is an uncomplicated process. You can register through the GST portal. But before you get started to register, you should get scanned copies of a few required documents because you will need them later in the process of registration.

List of Required Documents:

- Clear copy of Aadhaar Card.

- Copy of PAN Card.

- Address proof of the location.

- Bank Account proof. Bank Statement or Cancelled Cheque.

- Proof of Registration of Business.

- Address proof of Director.

- Identity Proof of Directors or Promoters.

- Proof of Authorized Signatory.

- (Digital Signature Certificate)

GST registration through GST portal:

- Visit the GST portal and click “Services.” A drop-down menu will appear. Hover your mouse over “Registration.” Click “New Registration” from the drop-down menu that will appear.

- Enter the required details accurately and press “Proceed.” In the space provided for Email ID and Mobile Number, Enter active Email ID and Mobile number to receive an OTP.

- On the next page, Enter OTP in the space provided. Enter the captcha and click “Proceed.”

- The next page will display your Temporary Reference Number (TRN). Click “Proceed.”

- Select the Temporary Reference Number ( TRN) option on this page and enter your TRN in the space provided. Enter the captcha and click “proceed.”

- You will get One Time Password on your registered Email ID and Mobile Number. Enter OTP and click “proceed.”

- You should see My Saved Application page. Here, in the action section, click the edit icon.

- Upload the required documents on the following pages. Enter accurate details in the space provided.

- After finishing the process, you will receive the Application Reference Number (ARN)on your Email ID and Mobile Number.

- After verification by authorities, you will get GST Registration Certificate. It will contain details of your registration along with your GSTIN.

GSTIN and its Benefits:

Goods and Services Tax Identification Number is a 15 digit unique number. It is to identify a taxpayer or a business under GST. GSTIN helps trace the supply of Goods and Services of a particular individual or company. Previous tax system provided Taxpayer Identification Number (TIN) for VAT payments, Inputs, etc. This number varied from state to state. With GSTIN, it is a unique number that brought all taxes under one GST online website.

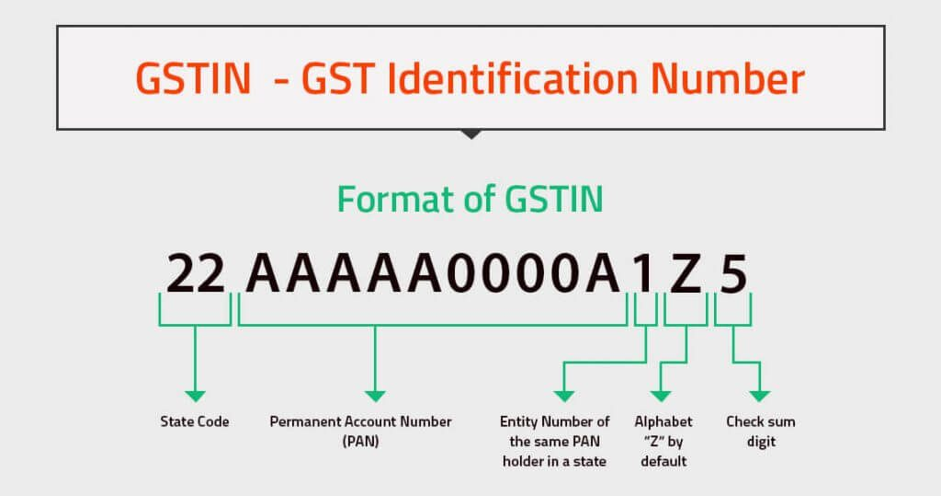

Format of GSTIN:

- The first two digits are numeric. It signifies state code.

- The next ten figures are alpha-numeric and are a PAN number.

- The following number is the entity number.

- The 14th digit is the letter ‘Z’ by default for everyone.

- The last digit alpha-numeric, and it’s check code.

Benefits:

- Getting GSTIN will help you gain more trust among people with whom you do business.

- It will help the government identify as a legitimate business through GST number verification, and you will be able to avail subsidies and any other government schemes for business.

- Small companies with a turnover of 1.5 crores or less can get into a composition scheme where they can lower the filing of tax returns;

- It helps companies run more efficiently.

- It will help save businesses from any untoward incident.

- Getting GSTIN will help get you a firm legal ground, and if there is any legal issue regarding the company, you can have a stronger position as compared to someone without GSTIN.

- It can help in avoiding authorities confiscating goods because any eligible taxpayer not registering under GST is an offense and may lead to the confiscation of the goods.

- Apart from the seizure of products, there could be a penalty of 10% of the total tax amount or Rs.10,000 whichever is higher in value.

Verification of Supplier/Buyer if they are legitimate

You will also be able to verify if the supplier or buyer you are dealing with is legitimate or not through GSTIN.

To verify authenticity, open the GST online website in any browser and click the “Search Taxpayer” tab.

A drop-down menu will appear. Click “Search by GSTIN/UNI. Click on that.

It will open a page with a space provided to enter GSTIN/UNI number.

Enter the GSTIN that you want to check and click “Search.”

With this simple procedure, you will be able to get an assurance about whether a particular individual or company is legitimate. It will help avoid any losses that could be a result of fraud.

Conclusion

It’s not just the benefits that you cannot avail of if you are not registered under GST and get GSTIN, but it is also the disadvantages that you can avoid. GST number verification is a great way to show that you are into clean business, and it helps with transparency with the buyers and suppliers and also with the government. You can verify other companies through GSTIN on GST online website and create a better network.

Author: I’m Jaylin: SEO Expert of Leelija Web Solutions. I am a content manager, and the author of elivestory.com and a full time blogger. Favourite things include my camera, travelling, caring my fitness, food and my fashion. Email id: editor@leelija.com

Related Posts